Prepaid Funeral Plans Pros and Cons

When it's important, we plan for it ahead of time. From college funds to weddings and home purchases, we are accustomed to putting money away for the pivotal and inevitable milestones in life. Setting aside money for your funeral is no different.

More and more people are pre-planning their funerals to save loved ones the stress of having to do it during such an emotional time. And when you make your own arrangements, it can also save money because you can specify which type of service you want and lock in today's prices.

But not all pre-paid funeral plans make sense financially, and regulations on prepaid funeral plans can vary by state and province. Let’s take a look at the pros and cons—what works, what doesn’t and what questions you need to ask to ensure you find the right plan for you.

In this article, you will learn about:

- Comparing prepaid funeral plans and final expense insurance

- Pros and cons of the different types of prepaid funeral plans

- What a prepaid funeral plan covers

- Whether you can cancel a prepaid funeral plan or get your money back

- What a guaranteed prepaid funeral plan means

- What happens if the provider where you purchased a prepaid funeral plan goes out of business

It can be lot of money, but planning and paying for your funeral or cremation in advance can ease your family’s burden in so many ways.

A prepaid funeral plan allows you to outline your funeral or cremation, choose the products and services you'd like to include, specify the details, and then pay for the arrangements over time in installments that fit your budget. When choosing a prepaid funeral plan, it’s important to understand the different types to determine which is best for you and your family.

Comparing final expense insurance and prepaid funeral plans

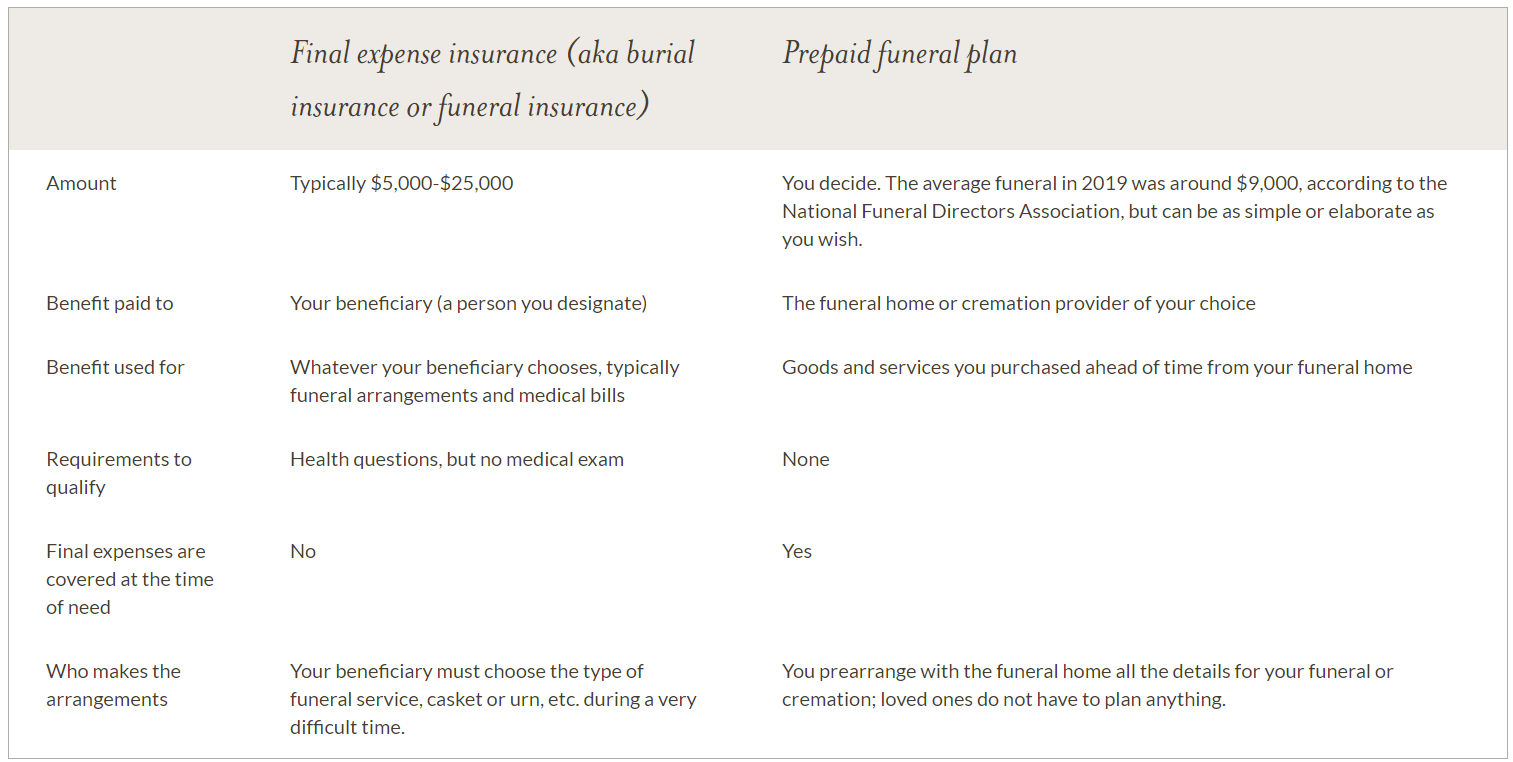

Prepaid funeral plans and final expense insurance both provide a way to plan ahead for the cost of your funeral. The difference is in the details.

Some people want not only to pay for their funeral or cremation in advance but also to pick the casket, cremation memorial, type of celebration, kinds of flowers and more. If that's you, then a prepaid funeral plan makes sense. It includes your detailed final wishes and the funds—paid right to the funeral home. Plus, it guards against inflation.

However, if you're less inclined to choose the specifics but want to know your family won’t face the financial burden of end-of-life expenses, final expense insurance may be the best choice. It pays a flat amount to your beneficiary for funeral and burial costs, as well as other expenses. The beneficiary decides how the money is spent, but there's no protection against inflation, so it's often recommended that you purchase a bigger benefit than the current funeral plan costs. It doesn't pay out immediately, though, and your family may have to handle funeral expenses out of pocket and wait for the policy to pay back later.

Our chart breaks it down.

Types of prepaid funeral plans

When you purchase a prepaid funeral plan, you choose the type of service you want, down to the smallest detail, and lock in today's prices on many items. Once you've made decisions such as burial or cremation, casket or urn, traditional service or celebration of life and sign a contract, your money is set aside with a third party, either via an insurance policy or in a trust account. That ensures your monthly payments are in one of the following safe places:

- Pre-need insurance policy: you pay premiums for a set amount of time—usually three to 10 years. The policy is in effect as long as your payments are up to date, and the benefit is paid directly to the funeral home. Dignity Memorial® providers offer pre-need insurance through American Memorial Life Insurance, which has an Excellent rating from AM Best.

- Revocable trust: money (a lump sum or payments) for funeral expenses is placed into a trust with a trustee or beneficiary that you can change. The trust can be cashed out or canceled whenever you'd like. The benefit is paid directly to the funeral home.

- Irrevocable trust: money (a lump sum or payments) for funeral expenses is placed into a trust that cannot be canceled. The trust has no cash value, and the money in the trust cannot be removed. Changes to the trustee or beneficiary or dissolution of the trust cannot take place without the permission of the trustee. Families usually designate a trust as irrevocable only as a state requirement for Medicare or Medicaid assistance. The benefit is paid directly to the funeral home.

What’s covered by a prepaid funeral plan?

When planning a funeral or memorial service, there are literally hundreds of details to consider and decisions to be made. Like any funeral or cremation, a prepaid plan can be personalized just for you.

When you sit down with a planning professional, he or she will first get to know you and your cultural and religious traditions, family customs and how you would like to be remembered. Then he or she will explain your full range of options, including the goods and services typically included in a funeral or cremation, as well as specialty items like keepsakes, remembrance jewelry, cemetery or cremation property, or even burial in an underwater reef.

Prepaid funeral plans usually cover these items:

- Services of a funeral director and funeral home staff. In addition to providing guidance and family care during planning and the day of the funeral, the funeral director and supporting staff are often on call around the clock. They make sure every detail is expertly handled, from scheduling flowers, clergy, speakers, music or catering, to obtaining permits and death certificate copies and more.

- Transportation to the funeral home and care of loved one. When a loved one dies, the funeral home will transport that person from home or a medical facility to the funeral home and then prepare the loved one's body for burial or cremation. Leading funeral homes follow strict custody procedures to ensure that there are no mistakes or mix-ups.

- Casket or cremation container. When choosing traditional burial or a traditional service prior to cremation, selecting a casket is an important step. Caskets are typically offered in wood or metal and can vary in quality and price. A cremation container is required by law and can take the form of an all-wood casket or a lower-price cardboard container.

- Cremation services and a container. Simple cremations come with a standard plastic container. You may also choose a sumptuous wooden box, eco-friendly scattering tube or classic urn to hold the cremated remains. These containers vary in price and can be made of wood, bronze, metal, glass or another material.

- Venue for the funeral and/or reception. Many funeral homes have beautiful chapels and modern reception areas designed especially for memorials. Some have spacious patios for outdoor gatherings or lawns for tented events.

- Catering. Food and drink can be as simple as a commemorative brunch of tea and pastries, as unique as serving a loved one’s secret recipe, or as elaborate as a full six-course meal.

- Transportation to the cemetery. A procession to the cemetery is part of some services. In those cases, a hearse may be needed as well as transportation for the family.

- Burial vault. For in-ground casket burial, many cemeteries require a vault, or outer burial container, into which the casket is placed. The vault helps maintain the integrity of the cemetery grounds. When burying an urn, a smaller urn vault may be purchased and is required by many cemeteries.

- Other items such as flowers, stationery, decor, keepsakes for family and mementos for friends may be planned and included in prepaid costs.

Prepaid plans may not include:

Goods and services provided by third parties. Be sure to ask your pre-planning advisor about typical third-party costs and if you can set aside money in your plan to cover items such as:

- death certificate copies

- cremation permitting

- clergy honorariums

- celebrant fees

- police escort fees

- musicians

Grave opening and closing costs or other cemetery goods and services, such as a grave marker or monument. Many Dignity Memorial funeral homes and cemeteries are sister locations, which means you have the convenience of making all your arrangements in one place and including funeral home and cemetery costs in one prepaid plan. However, that's not true of every funeral home, and cemetery costs may need to be planned separately.

Can I cancel a prepaid funeral plan and get my money back?

If your prepaid funeral plan is funded through a revocable trust, you can cancel the contract and get most of your money back (the trust keeps a cancellation fee to cover administration costs). On the other hand, an irrevocable trust cannot be canceled. It can be transferred to a different funeral home, though you may lose price protection. If your prepaid funeral plan is funded through an insurance policy, you do not get a refund of premiums paid.

What does a guaranteed prepaid funeral plan mean?

In addition to protecting your family from financial stress at the time of your death, prepaid funeral plans can also help you save money. When you buy a guaranteed plan that specifies the exact goods and services you want, the price you agree to is locked in, no matter when your death occurs. That means even if prices go up, your loved ones won’t have to pay more.

Average funeral prices have gone up 97% in the last 28 years.

Non-guaranteed plans don’t offer protection against rising prices, so if you choose a casket today that costs $3,000 and the least expensive casket is $4,000 when you need it, your loved ones will have to bridge that gap.

What happens if the funeral provider goes out of business?

It’s a common misconception that if you purchase a prepaid funeral plan and the funeral home goes out of business that you lose all your money. State laws require that prepaid funeral plan payments be securely invested with an independent entity—an insurance provider or trust—so that if the funeral home you made plans with goes out of business, the funds in your plan can be transferred to another provider.

When you plan and pay in advance with a Dignity Memorial provider, you get a promise that your funeral plan will be honored by any one of more than 1,900 locations in North America. What's more, your plan can be transferred at any time to a location more than 75 miles away from where you purchased it—that's part of The Dignity Difference.

Get started

Our free Personal Planning Guide helps you get started with funeral planning. When you're comfortable, a planning professional can answer your questions and walk you through the final steps of designing and paying for a funeral that tells your special life story.

Contact us to speak to a planning professional today.

Your Prepaid Cremation Questions, Answered

Contact A.C. Cedillo

Audelio.Cedillo@funeralpreplanners.com

Website created by True Digital Marketing